As you can read in my post "Elliott Wave Outlook on August 2010" I expected a very bullish August with a possible hit of 1200 late in the month. The reason I was this bullish was on one hand a possible bullish Elliott Wave count and on the other hand my cycles which were pointing up.

In the first week of August it looked like this market was really going to rally towards 1200. Already on August 2nd, the first trading day of the month, the SPX rallied near to 1130 (July finished at 1102). But that was it for the bulls. Several attempts to break 1130 failed and thus in the morning of August 11th when the ES was trading at 1108 (~ SPX 1111) I revised my Elliott Wave count and turned bearish. Since then, the SPX has lost more then 60 handles erasing most of the July gains.

Outlook on September:

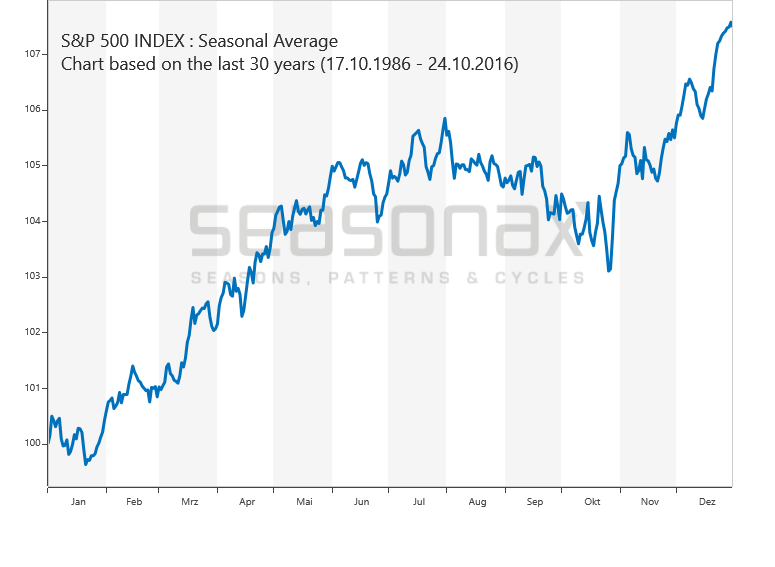

The stock market is entering the statistically worst month of the year:

This doesn't necessarily mean that the market has to decline next month but there is much to be said for it:

- A bearish Elliott Wave count

I think you're familiar with the following count:

I've been using this count since August 11th and at this point I don't see any reason to discard it. As I mentioned earlier today wave [i] could have ended at 1041 today but I clearly prefer an extended fifth wave ((v) of [i]). The extended wave (v) could end everywhere between 980 and 1030. I'll determine some objectives as the wave unfolds. After the completion of wave [i] a second wave will unfold and retrace about 50 % of the first wave down.

Zoomed out. Nothing new. Minor 1 bottomed at 1040 and Minor 2 topped at 1130. Currently in the early stage of Minor 3.

- The big-ass H&S

I think you know of which H&S I'm talking ; )

I added a red MA 76 to the chart. You can see that this MA provided support several times during 03-07. In 2010 it's getting tested the second time. Will it hold this time?

- The Hindenburg Omen

Almost everywhere one could read about it and it may be questionable if it's still useful because everyone knows about it. But the stats are impressive:

"The probability of a panic sellout was 41% and the probability of a major stock market crash was 24%." (source: http://en.wikipedia.org/wiki/Hindenburg_Omen)

Panic sellouts are defined as declines above 10 % and major stock market crashes as declines above 15 %.

So, will the stock market fall in fall? It seems so, unfortunately. The only chance I see for at least a bullish September is if 1040 holds and we get a strong rally starting tomorrow. But I'm not posting a bullish alternative count here I'd do that once we got that rally ; )

Edit Sept 1st:

Since we got the mentioned big rally on September 1st I'm posting a part of my post http://www.wavaholic.com/2010/09/s-500-elliott-wave-count-1-september.html with an alternative bullish count:

"This would be the wave count for this scenario:

It's not a perfect 5 wave move down, it looks more like a three wave move, doesn't it? But it's possible to count it like that and the target for wave [ii] is around 1100.

Another possibility is that we get a big rally like in early July, hence up to 1130-50 until mid September:

It's easier to count the move from 1130 to 1040 as three waves in my opinion. 1040 finished [b] or 2 and [c] or 3 is underway now with a target above 1130."

Have a great month!